US faces historic shake-up in 2024 presidential polls

What’s shaping up like a déjà vu moment quickly shifted into a history-making election season in the US.

It will be a thrilling next few weeks as the US heads into another presidential election. What would have been a repeat standoff between incumbent President Joe Biden and former President Donald Trump has taken wild turns, with Vice President Kamala Harris replacing Biden. Market players pretty much knew what to expect from Biden or Trump as they have seen the country under both leaderships – and during the COVID-19 pandemic, no less.

What would a Trump vs Harris faceoff on 5 November mean for the financial markets? Offhand, we think market players will take a cautious stance as they await clarity on the future economic policies for the world’s largest economy. We believe investors should remain overweight on US stocks barring any major shocks, while succeeding rate cuts from the Federal Reserve will keep everybody happy.

US stocks climb

US stocks rallied following Biden’s shock announcement to leave the race, then attributed to the recovery of tech stocks after tumbling in previous weeks when Trump said he would further distance the US from trading with China. Positive economic data pushed stocks to reach new highs in September.

Politics is politics, and investors are aware of that. Share prices are generally unfazed by electoral maneuvers in the long term nor do they cause prolonged periods of volatility.

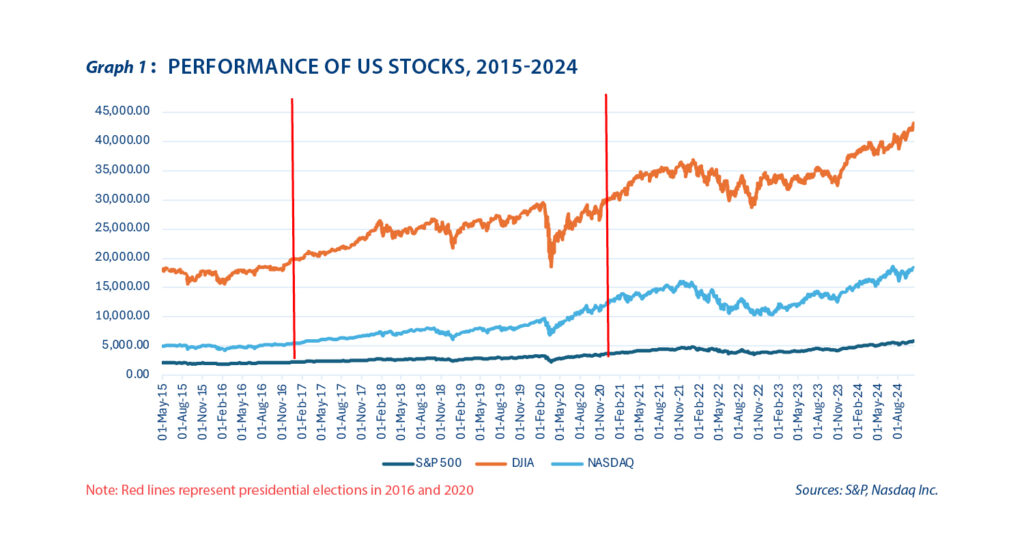

The American stock market had a strong start in 2024, even setting all-time highs in March, May, and early July. The rally sustains a winning streak since late last year but is unlikely to be attributable to the elections. We believe that election jitters, if any, are felt in US stocks within two to three months running up to voting day – and it is not a huge factor as one might think.

Graph 1 illustrates very little fluctuations in the S&P 500, Dow Jones Industrial Average, and the NASDAQ Composite stock market indices during election seasons, with major stocks reacting to economic news that affect long-term sentiment more than political noise. As JP Morgan explains, stock markets often rally after election day as the results are out, which takes away the uncertainty over US leadership.

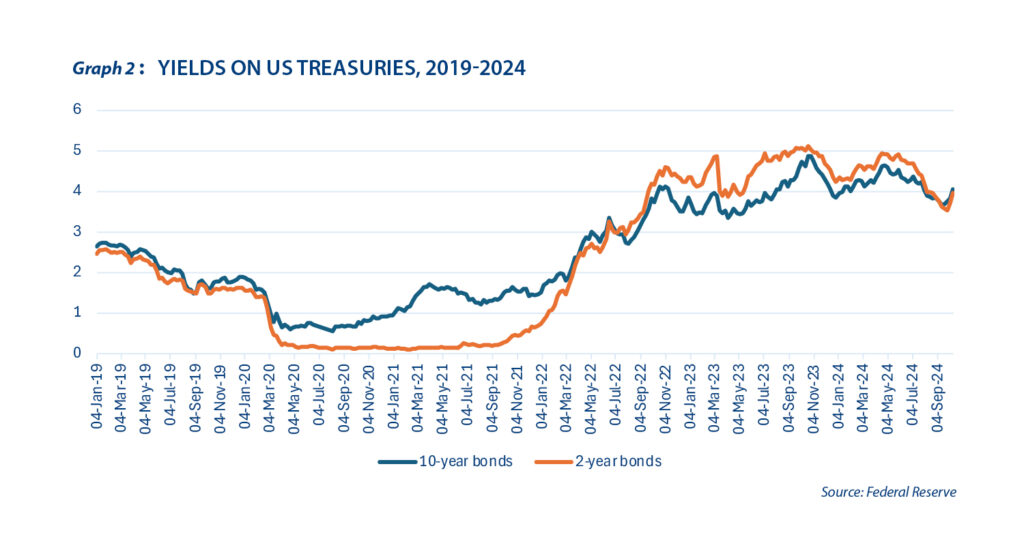

Fears of a “hard landing” of the US economy dissipated in early 2023, making way for renewed optimism towards US investments. However, the two-year inversion of the yield curve – where returns on two-year Treasury notes are higher than yields on 10-year bonds –had renewed jitters regarding a possible US recession. This was the longest period of yield curve inversion in US’ economic history, dating back to July 2022 as seen in Graph 2, and reflects how traders believe that short-term risks outweigh gains from taking long-term positions. Spreads have normalized since September as the Fed began its rate cutting cycle.

We think recent recession fears are overblown as global investors are merely trying to maximize gains from US Treasuries ahead of even lower interest rates after a 50-basis-point reduction this September. The Fed is looking closely at job creation and unemployment data to guide future rate adjustments.

High interest rates in the US coupled with decelerating inflation and faster job creation have been propping up American stock values. The fate of the stock market will continue to depend on how corporates perform and how the federal government will manage its ballooning budget deficit.

Eyes on the Capitol

We think another exciting battle to watch out for will be in Congress. After all, the legislative branch brings to life the reforms (or lack thereof) of an administration.

A separate quest for dominance is unfurling in the Senate and the House of Representatives. Party control over the House, which is composed of 435 seats, has varied greatly over the last 10 Congresses. The division is more pronounced in the Senate in recent years, with current seats split 48-49 for Democrat and Republican senators, respectively.

Two outcomes would be critical for Wall Street: whether the next President will win only the Oval Office, and which parties will rule the legislative chambers. Surveys as of mid-October show Harris (48.5 per cent) with only a narrow edge against Trump (46.1 per cent) but Congress will likely turn out Republican.

Trump is looking to return to the White House after his 2020 loss to Biden which he continues to contest. If elected, he plans to reduce social assistance programs, downsize the federal government, tighten border controls, and impose steep tariffs on imports particularly those coming from China. Harris, meanwhile, wants to provide subsidies for first-time homebuyers and set caps on food price increases as a tool for inflation control. These plans require legislation to be enforced, and this is where party domination in both chambers is most useful. A Harris win will most likely trigger a sell-off in US Treasuries as markets expect her spending policies to inflate federal debt from the current level of 119 per cent of GDP.

A party’s decisive control over Congress would give clarity on the direction of national policies. If anyone needs a reminder on how powerful the US Congress is, recall the episodes of a government shutdown under Trump and under former President Barack Obama that paralyzed the entire federal government because lawmakers were unable to enact the national budget on time.

All told, it looks like a tight race to the White House and in Congress. Beyond political maneuvers, we advise watching out for cues on policy statements which would ultimately dictate how the US economy moves forward. Our primary scenario is we remain overweight on US stocks but are keeping a watchful eye on the outcome of the US elections.

This original article has been produced in-house for Lundgreen’s Investor Insights by on-the-ground contributors of the region. The insight provided is informed with accurate data from reliable sources and has gone through various processes to ensure that the information upholds the integrity and values of the Lundgreen’s brand.