Thriving Brazilian agriculture builds new pathways through capital markets

According to the Production, Supply and Demand reports by the US Department of Agriculture, Brazil is responsible for more than a quarter of the world’s production of key agricultural goods like fresh oranges, soybean oilseed, and coffee, along with a significant share of products such as sugar, meat, cotton, and corn.

With the evolution of Brazilian agribusiness, the sector has accounted for 24 per cent of the country’s GDP since 1994. The sector’s production, which was expected to reach an impressive BRL 2.6 trillion in 2023, was not the only aspect that’s remarkable about it; its significance in terms of employment provided livelihoods for over 28 million people. That constitutes approximately 26 per cent of the domestic labor market.

Agribusiness drives economic growth

Beyond the national front, agricultural exports have been pivotal in the country’s trade balance and economic stability. In 2023, agribusiness exports reached a historic high of USD 166.55 billion, being responsible for 49 per cent of the total Brazilian export basket that year. The sector has also delivered an astounding surplus of nearly USD 150 billion, effectively offsetting the deficit coming from industry and services. What is more relevant is that agricultural sales have consistently guaranteed trade balance surpluses for over a decade and counting.

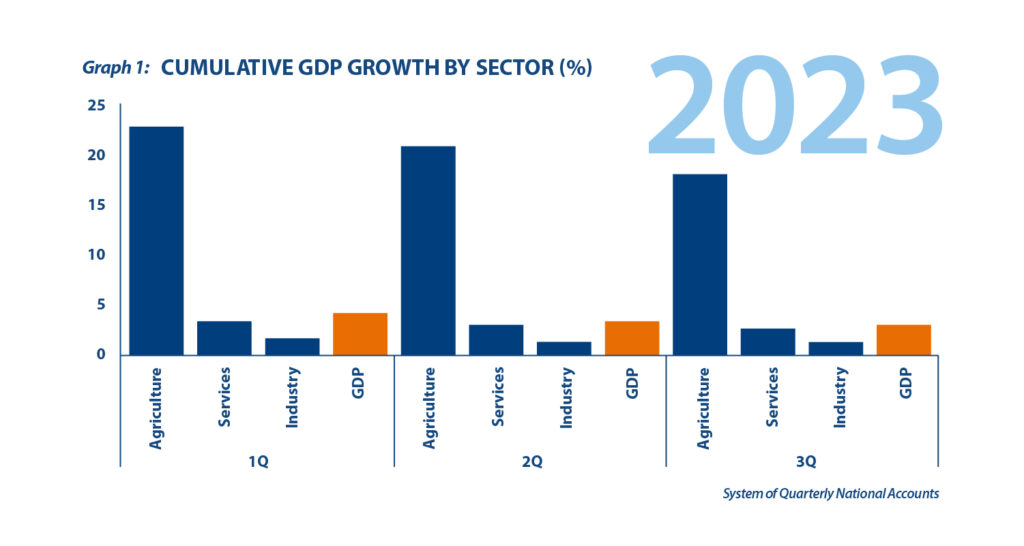

Moreover, Brazil’s robust agriculture sector is not just a historical foundation of economic strength; it is a dynamic force that continues to shape the nation’s growth. In the third quarter of 2023, the economy remained relatively stable compared to the previous quarter. However, it followed substantial 1.4 per cent and 1 per cent increases in the first and second quarters of the year, respectively. These numbers added to a cumulative growth of 3.2 per cent from January through September when compared to the same nine months of 2022. As showcased in Graph 1, agriculture once again played a significant role in Brazil’s growth with an impressive 18.1 per cent GDP growth in 2023.

While the third quarter saw a steep 3.3 per cent dip in agricultural GDP from the previous quarter, it was not unexpected due to the hard comparison with the outstanding performance in the first six months with expressive crops harvested. Still, in the year-on-year comparison, which considers the sector’s performance in the same periods in 2022, agriculture has exhibited extraordinary performances in all quarters of the year. These outcomes highlight the robustness and adaptability of Brazil’s agriculture sector, emphasizing its crucial role in the nation’s economic landscape.

Although traditionally reliant on private capitalization and government programs, the agribusiness sector is undergoing a transformative shift towards greater engagement with the capital markets. This transition is bringing forth new possibilities, such as private credit products tailored for agricultural financing, agriculture-related indices and exchange-traded funds or ETFs, and innovations like Agro-industrial Chain Investment Funds (FIAGRO) akin to real estate investment trust (REIT) products in the US. Additionally, recent IPOs of agricultural companies signal a growing alignment between the local financial markets and the agriculture sector, boosting access to financing and sustaining the growth of the farm sector.

Triumph in capital markets with FIAGRO

One of the most promising innovations within the Brazilian capital markets movement towards the agribusiness sector has been the creation of the FIAGRO asset class, which are investment funds for investing in agribusiness investment assets. The financing of the sector can be done through three different categories: investment funds focused on agroindustry that invests in credit rights, funds with real estate assets, or investment funds in partnership interests. These funds are exchange-traded, and the income obtained from the sale or rental of rural properties is distributed periodically to its shareholders in the form of dividends.

The first fund is on its third year and the class has been a success ever since, with the net worth of all funds reaching BRL 20.5 billion in December 2023. In Brazil, REITs took 10 years to match what the net worth achieved by the FIAGRO in only three years. Besides that, the evolution of outstanding shares and number of investors have also reached record figures by yearend, as illustrated in Graph 2.

The development of investment products in the agricultural sector opened doors to a range of investment opportunities, linking one of Brazil’s oldest economic pillars with modern financial innovations. A deeper understanding of the agricultural sector especially by individual investors, the improvement of macroeconomic conditions, and the conclusion of the downward cycle of the Selic basic interest rate will play a crucial role in the development of this class. The meeting between agriculture and capital markets has the potential to not only reshape Brazil’s economic dynamics but also provide investors with multiple paths to growth and prosperity in this thriving industry, especially over the long term.

This original article has been produced in-house for Lundgreen’s Investor Insights by on-the-ground contributors of the region. The insight provided is informed with accurate data from reliable sources and has gone through various processes to ensure that the information upholds the integrity and values of the Lundgreen’s brand.