Propping up Malaysia’s economy amid weaker ringgit, unyielding interest rates

Malaysia experienced slowdowns in global trade, elevated tensions due to geopolitics, and tighter monetary policies that led to a slower-than-expected 3.7 per cent expansion in 2023, missing the expected pace of 3.8 per cent. Still, the International Monetary Fund (IMF) predicts a positive outlook for a potential increase of up to 4.3 per cent in 2024.

Malaysia also contends with the challenge of a depreciating currency but has kept the benchmark interest rate at 3 per cent over the past year. Despite elevated borrowing costs, higher yields are used to attract additional foreign investments.

Gloomy indicators

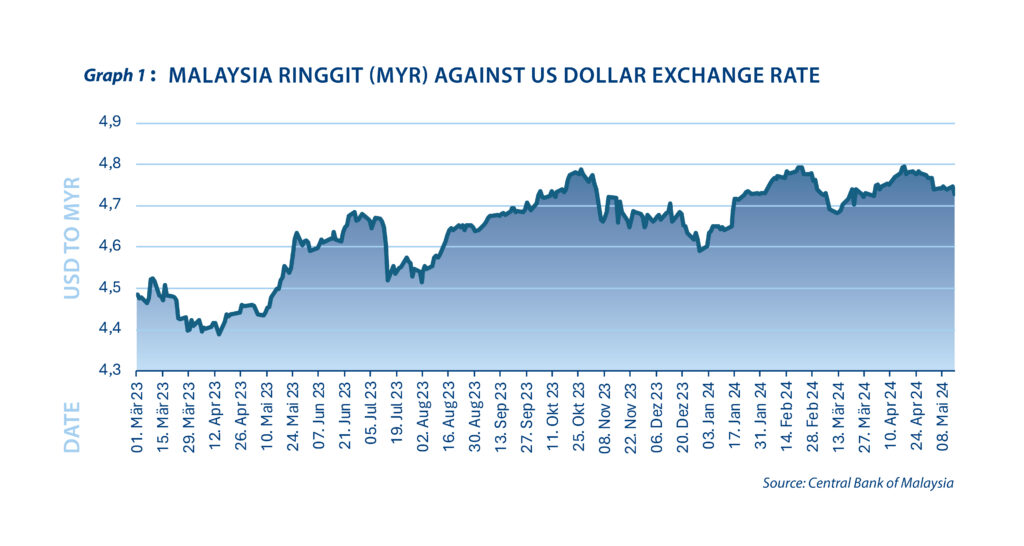

As illustrated in Graph 1, the Bank Negara Malaysia (BNM) saw the ringgit experience two significant depreciations between March 2023 to March 2024, with the fall reminiscent of the exchange rate performance at the height of the 1998 Asian Financial Crisis. What caused this spell of ringgit depreciation?

First, consider internal factors – in particular, how the level of gross international reserves affects the exchange rate. Dollar reserves stood at USD 113.8 billion as of end-March based on BNM data. The amount is sufficient as an import cover for 5.6 months but just matches the country’s stock of short-term foreign debt.

External factors also play a role in the apparent undervaluation of the ringgit, such as the movement of the Chinese currency and its relation to the depreciation of the Malaysian currency. China’s economic slowdown has depressed demand for Malaysian exports, with total outbound shipments declining by 0.1 per cent year-on-year. If the sluggishness of China’s economy persists, every 1 per cent decline in Chinese GDP is estimated to reduce Malaysia’s economic growth rate by 0.6 per cent. Fewer exports will also result in a wider trade deficit.

Another factor is the economic influence of the US on global interest rates. The US dollar continues to strengthen relative to other currencies as the Federal Reserve has yet to unwind the series of rate hikes it introduced since 2022, keeping onshore margins higher relative to the rest of the world.

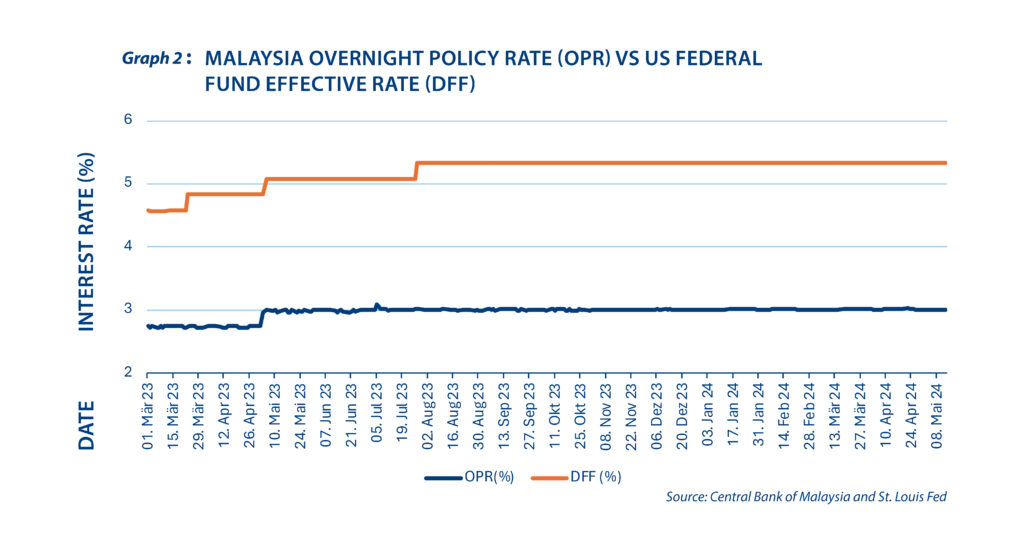

Graph 2 illustrates a substantial gap worth 183 to 230 base points between the Malaysian and US policy rates. This gap between domestic and global interest rates triggers investment outflows since higher interest rate abroad allows investors to obtain more competitive returns. However, the BNM has kept the overnight policy rate at 3 per cent for many months, attempting to stabilize domestic inflation and stoke faster and healthier economic growth amidst a slowing global economy.

BNM is aware of the ringgit’s undervaluation and has committed to provide “more enduring support” to the currency and rein capital flows back into Malaysia through its state-owned corporations.

Light amid uncertainty

Amidst the uncertainty affecting Malaysia’s economic position, there are opportunities being utilized to meet the economic growth targets set by the national government.

According to the Malaysian Securities Commission, the statutory body regulating and developing the Malaysian capital market, the capital market grew by 5.6 per cent in 2023, reaching MYR 3.8 trillion.

While the ringgit’s value experienced a severe decline after 26 years, this fall has not bled through the broader stock market. In fact, foreign investors have been taking the opportunity to invest in Malaysia with a stronger base currency while enjoying the potential for a huge economic upturn.

For trade, export-oriented sectors heavily depending on local inputs benefit greatly as they make bigger profits when dollar sales are converted into ringgit. Malaysia’s merchandise exports rose by 2.2 per cent in the first quarter of the year with increases in both the value and volume of goods. This came from the outbound shipments of iron and steel products, machinery, equipment and parts, petroleum products, and liquefied natural gas. Imports grew by 13.1 per cent to MYR 328.186 billion (USD 68.69 billion), resulting in a trade surplus of MYR 34.22 billion (USD 7.16 billion). This is the biggest quarterly trade surplus in Malaysia’s history.

The weakness of the ringgit also has a spillover effect on the tourism sector. In 2023, total tourist expenditures in Malaysia stood at MYR 71.3 billion (USD 14.92 billion), more than double the amount tallied in 2022 as pandemic restrictions have been fully lifted. According to Deputy Tourism, Arts and Culture Minister Khairul Firdaus Akbar Khan, the government hopes the sector will generate MYR 375.3 billion (USD 78.55 billion) in three years. This also opens up opportunities in the medical tourism sector. Based on the statistics of the Malaysia Travel Health Council, health travellers brought in revenue of MYR 1.3 billion (USD 272 million) in 2022. With the increase of MYR 1.92 billion (USD 402 million) in revenue seen in 2023, the government is confident the sector can achieve MYR 2.4 billion (USD 502.29 million) this year. This indirectly opens opportunities in other industries such as accommodation management for health travellers and logistics that will support even greater economic activity.

Although the value of the ringgit decreased significantly, the Malaysian government is seeking to regain some strength for the currency to a rate of MYR 4.20:USD 1 by the end of 2024. If this comes into fruition, the construction sector will benefit. Items such as steel bars and cement play a significant role in reducing construction costs which can motivate developers to complete large-scale housing and public transportation projects on time. With the weak ringgit now, every 1 per cent depreciation of the ringgit leads to a 0.15 to 0.25 per cent increase in construction costs.

Fortunately, the construction sector in Malaysia recently experienced high growth, with the first quarter in 2024 seeing 11.9 per cent growth compared to 3.6 per cent the previous quarter. According to BNM, the total value for construction work this first quarter, including those done for the property market, is MYR 36.8 billion (USD 7.84 billion).

Favorable policies on foreign ownership in Malaysia’s property market encourages foreign investors to buy property and do business there. Imports in the trade sector likewise provide cheaper supply of foreign-made goods, benefiting both foreign producers and Malaysian consumers.

Currently, Malaysia surpassed earlier expectations of economic growth of 3.9 per cent, posting a 4.2 per cent expasion during this year’s first quarter. Despite headwinds from China and the troubled global growth outlook, Malaysia demonstrates resilience and business confidence with small businesses seeing greater consumer confidence. With clear policies and diverse product options, foreign investors can cash in from the ringgit’s fluctuations.

This original article has been produced in-house for Lundgreen’s Investor Insights by on-the-ground contributors of the region. The insight provided is informed with accurate data from reliable sources and has gone through various processes to ensure that the information upholds the integrity and values of the Lundgreen’s brand.