It feels like November 1985

There is no doubt that the global economy is not exactly bursting with momentum, which may stress equity investors, especially in a financial world returning to the normalcy where liquidity has a price.

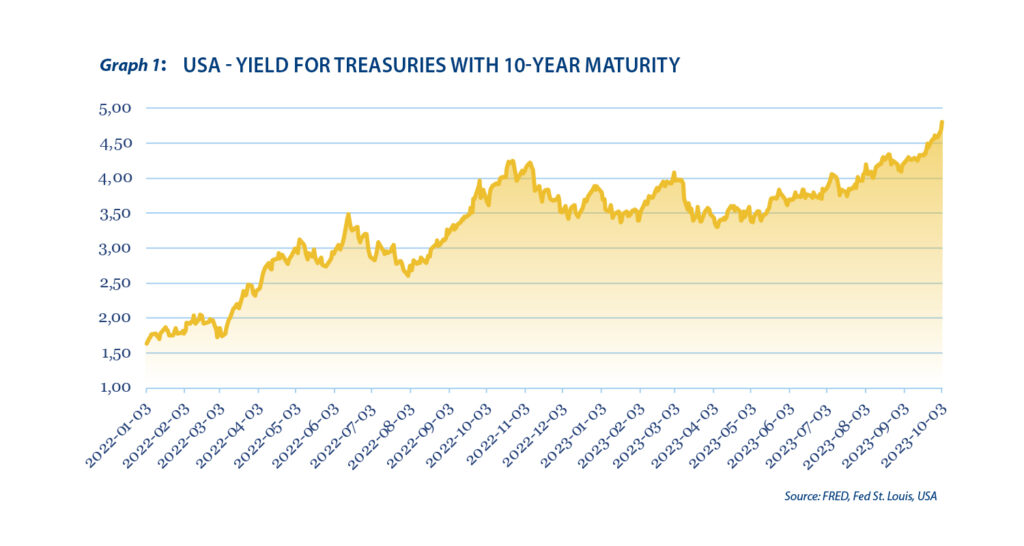

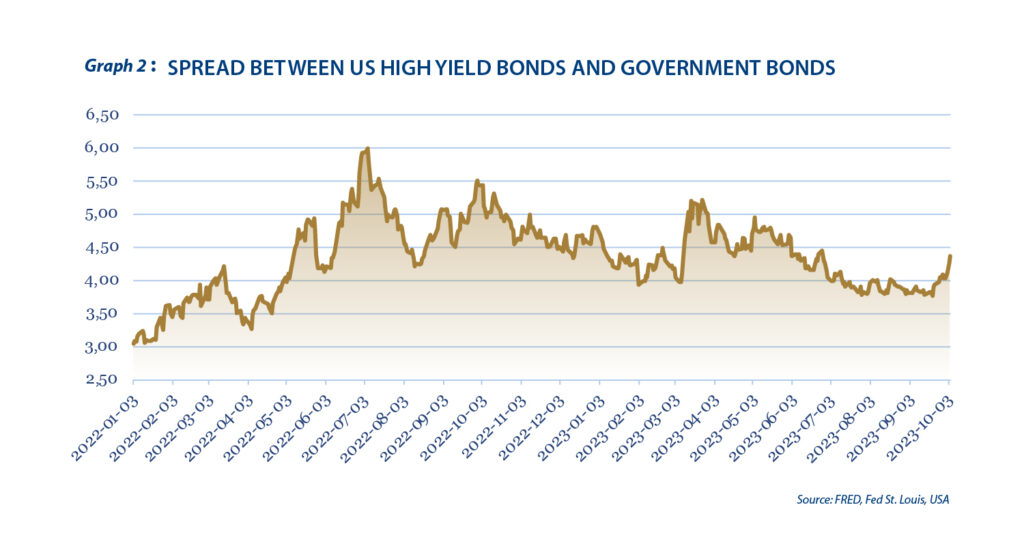

Right now, the stress is even more pronounced in the bond markets, where the frustration is the inflation that still is not under control, especially in western economies. This has pushed interest rates up further, as graphic one shows, but conversely, graphic two shows that the credit market is not under pressure yet.

I view the past couple of weeks of declines in bond markets as a fairly late reaction in this cycle, particularly outside of Europe. It remains to be my view that the majority of bond investors soon will begin to look forward to the life after the high inflation period.

This does not change the fact that investors must search further to find good investment opportunities, and perhaps even work mentally on how to perceive developments. I think the World Bank’s latest assessment of the Asian economy is a good example. The growth prospects for the whole of East Asia were downgraded to 4.5 per cent GDP growth this year. The World Bank has commented that it is the lowest growth prospects for the region in more than 50 years – should investors be even more stressed by that?

No, because the consideration is one-dimensional, and partly just an observation. When global growth is under pressure, as it is now, it is felt everywhere, including in Asia. The hum is that Asian growth is after all, more attractive than elsewhere, but more importantly, it is also changing character. A great example is entrepreneurship, which a few decades ago was very much characterized by necessity, perhaps the only source of income was selling street food to tourists. Today, Southeast Asian entrepreneurship originates much more from households with saved capital and with ideas that create the base to establish new small growing businesses. It is just an example of how economic growth changes character, thus becoming a more self-reinforcing and revenue-generating in a different highly qualitative manner. For investors, this is an incredibly important development because the opportunities look different than before.

A good stress therapy for investors could be to deal with megatrends, as these long-term convictions provide a compass direction whenever the markets get rough.

Recently, I had a conversation about the global capital movements into green energy up to 2050, which is the biggest trend I have ever been able to point to in the financial markets. The best assessment I have is that no matter how much money and new ideas are generated, the UN’s climate goals will not be achieved. It may seem worrying at first glance, but an infinite number of good ideas and measures are coming, which is the good news, and they will have a positive effect. But at the same time, it also describes a gigantic wave of investments that one, as an investor, can choose to either simply observe or actively participate in.

This green wave reminds me of another wave that was set in motion on the 20th of November 1985. It was the day of the official launch of Microsoft’s Windows. I consider it a product that over time, changed global everyday life, and created the largest companies and sectors in the entire world. I have the same feeling about the new green deep tech energy technology wave, which has only just begun.

When I mention a green technology wave, I am primarily thinking of “green deep tech” and not, for instance, investments in wind turbines. As an example, for several years now, my own company has been involved in investments into CO2-negative oil production, which has also brought us on to other opportunities. The next option in line is possibly the production of CO2-negative jet fuel, which will be a huge step forward, and it really is an exciting world.

I expect investors who are already allocating extra time to a detailed understanding of green deep tech to reap an additional gain from another front. At the moment, inflation is a stress factor, but at some point, inflation will subside. However, it will return in a green form, because green consumption taxes are inevitable, it’s just a matter of time before they are introduced. I equate the taxes that are coming with a green VAT to create a new form of inflation. Ideally, the future green VAT will be earmarked for the green investment wave, but time will tell if that is the case.

The coming green inflation will stress the financial markets again, because I expect the green tax/VAT to increase every single year. One way for investors to counteract the negative effect of green inflation is through investments that profit from green taxes.

If one takes a step back from the current sourness in the financial markets, they might see a number of exciting investment opportunities. It may be in new geographical areas, but certainly in new sectors, and I can confirm that it takes a lot of time and energy to take that journey. On the contrary, it is one of the many exciting aspects of being an active investor, and I am absolutely convinced that the world is facing a new gigantic investment and technology wave, like back in November 1985.