Re-assessing the US Budget Deficit

The first US presidential debate for the November 2024 polls shed little light on the elephant in the room: the federal budget deficit.

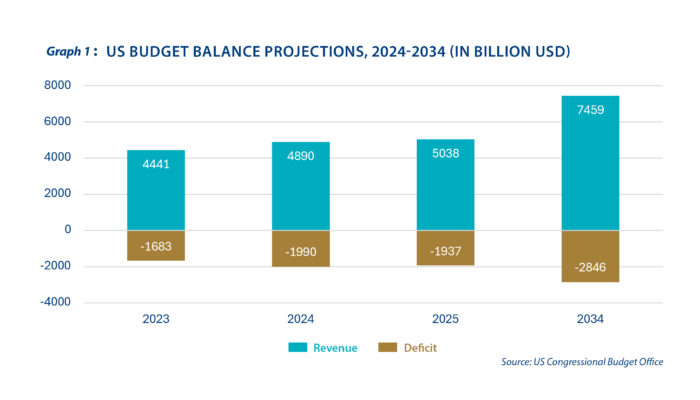

If further tax cuts are to be on the economic agenda, the US shall run annual fiscal deficits over the next decade. As a result, gross federal debt – which was at USD 8.95 trillion equivalent to 61.8 per cent of GDP in 2007 – has surged to USD 30.8 trillion or 119.8 per cent of GDP in 2022. As of end-2023, federal debt already amounted to 120.6 per cent of GDP. Bigger federal debt payments take away funding for new public projects, which could possibly slow down economic growth in the long run. Further, large budget deficits typically translate to higher inflation and lower bond yields in the long term.

Debt and taxes

It is fair to say that running on large deficits is a key feature of the US economy. In 2019, this large deficit was less of a concern due to the low-interest rate environment that kept financing costs down. Back then, the impression was that cheaper borrowing rates provided more leeway for the level of debt which the US can sustainably bear.

Many view deficit spending as a viable strategy to bolster economic growth and is seen as good news by investors because stocks tended to perform well in the years that follow. However, the ballooning budget deficit has proven worrisome. In 2023, Fitch Ratings downgraded the US’ credit rating over the enlarged fiscal gap and loose federal policies to keep government debt under control.

There’s no such thing as free lunch, and aggressive borrowing to finance these large deficits will eventually catch up with the US economy. Tax cuts for the wealthy, as well as a pause in taxing Social Security benefits, could add to the deficit. Extensions of tax cuts to Americans earning less than USD 400,000 while increasing the corporate tax rate to 28 per cent (lower than the rate prior to 2019) will not alleviate the deficit burden either.

During crisis situations, it is almost always the case that raising tax rates is an option for anyone who is in office, albeit an unpopular political move. Such a quick fix provides a revenue boost in the short term but has the potential to stunt economic growth in the long term as it discourages consumption.

Additional borrowing from the government will also push bond yields even higher and trigger faster inflation, sending the economy back into the cycle of high interest rates and a heavier debt burden. The US Congressional Budget Office (CBO) projects that the yearly budget deficit will remain between 6.5-6.9 per cent of GDP until 2034, much larger than the 3.7 per cent annual average between 1974-2023. Changes in the pace of productivity growth, labour force growth, inflation, and interest rates could significantly widen the fiscal gap by nearly double, the CBO’s analysis show.

However, there is limited scope for the US to drastically reduce the size of its budget deficit. To do so would require spending cuts for low-priority expenditure areas, such as those unrelated to healthcare and social services. However, these may not be substantial enough to convincingly reduce the budget gap. At best, such spending cuts, along with possible fiscal reforms pursued to prevent another fiscal crisis, would ease the need for additional government borrowings.

Fiscal gap to stay

Regardless of the outcome of the presidential election, we are looking at the prospect of increased fiscal pressure and therefore an eventual increase in interest rates in the US, together creating an expensive environment for additional federal borrowings.

Graph 2 shows there has been a noticeable surge in yields since mid-2022 when inflation climbed to as high as 9.1 per cent and in the aftermath of the COVID-19 pandemic. The 10-year Treasury yield was just slightly above 0.5 per cent in the second quarter of 2020, which increased to around 3 per cent come 2022. Now, Treasury yields are hovering above 4 per cent. Yields have risen in real terms too, trending well above the 10-year breakeven inflation rate that represents the level of price adjustments expected by the market.

Amidst the expectation of further interest rate cuts by the Federal Reserve, the risk of a bond market slump seems far in the horizon. However, the opposite scenario will occur depending on the economic policies that will be implemented by the winning party from the US elections on 5 November. Amid heightened uncertainty, investors should avoid long-dated Treasury bonds in the meantime as the prices of these instruments are highly sensitive to the long-term outlook of US economy. For US stocks, we remain overweight but continue to monitor the outcome of the polls and its impact on Wall Street shares.

Beyond the presidential race, much of the US’ future, including its ability to manage federal debt and the budget gap, will be shaped by Congress. If the next President secures full control over Capitol Hill, it would be much easier to get their legislative agenda going, and this includes issuing even more debt to finance the programs of the incoming administration. Currently, either candidate has not laid out significant reforms that would substantially lift US economic activity.

At present, attitude towards US investment instruments is very much coloured by concerns regarding the large budget deficit. Persisting budget deficits will likely lead to soaring inflation and interest rates, and the eventual tax hike. Still, we continue to prefer long-term US bonds as we monitor the pace and magnitude of the Fed’s rate cuts, which remains to be the most dominant force in the market.