No one is hoarding toilet paper in the UK

For someone living a perfect life, a regular bump on the road can feel like a deep and enormous hole in the road. In a life that might be too perfect, even the slightest disturbance may suddenly feel like a huge challenge and receive overwhelming attention. Since the global financial crisis, the financial markets, and investors in general, have lived a perfect life, at least until the Covid-19 crisis.

The central banks have steadily flooded the markets with liquidity for the past ten years, so it has been like giving candy to the investor’s daily life. During the decade, investors have enjoyed positive returns from the stock markets almost daily– a perfect life, so to say.

Since the Brexit vote on the 23rd June 2016, the result has been viewed as an enormous hole in the road. The Brexit has disturbed the perfect life severely and has led to huge selloffs in the global stock markets several times. Now, two months before what could end up as a true hard Brexit, the Brexit has no one’s attention, which is interesting.

Just last year, in mid-August, British consumers have been hoarding all kinds of daily needs totalling to GBP four billion, which includes the famous toilet paper. The hoarding even reached new heights during a massive coverage in the British press, and consumers bought even more survival boxes. The hoarding found its zenith 2 ½ months ahead of the threatening hard Brexit, by the end of October last year.

Currently, the same situation is facing the Britons, as there are 2 months to the next deadline, and this time, the Brexit is highly likely to happen. The negotiations between the EU and the UK are taking place, but not moving forward, so a hard Brexit takes a high percentage of the likely outcome.

So far, I have just seen one article in a British newspaper covering what the households should buy to secure their daily lives after a hard Brexit, though as it was mentioned in the article “if anything at all”. Obviously, the Britons are not hoarding the infamous toilet paper, and the explanation is easy.

The answer of course, is the Covid-19 pandemic, which is a true crisis. It’s not just an economic crisis, but also a real threat to the well-being of each individual citizen. This has a completely different impact and dimension compared to if a supermarket runs out of cucumbers or some fruits due to a delivery shortage because of the Brexit.

The missing hoarding could be explained with the stock of tinned tuna fish, dried fruit, olive oil etc. that has been built over the past year among British households, as consumers also hoarded when Covid-19 took off in the UK.

Though other typical items for hoarding are currently not in unusual demand either. Based on this behaviour, I speculate whether British households (and voters) are exploring the Covid-19 crisis as a true crisis, which thereby put even a hard Brexit into another perspective? It could very well be that compared to the Covid-19 crisis, the Brexit is now viewed as a change, and no longer as “a crisis”.

When investors are living the perfect life, it’s possible that big or maybe even turbulent changes that like the Brexit, could be overshot by the financial markets to be “a crisis”. There are also other indicators pointing at the likelihood that even the risk of a hard Brexit, is not as disastrous as the stock markets are indicating.

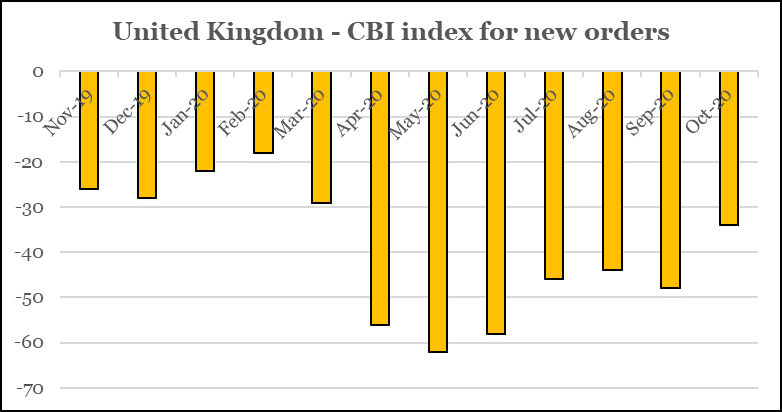

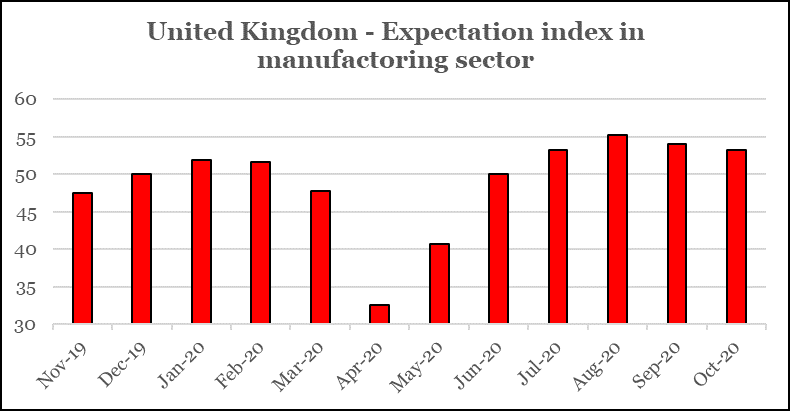

Graphic one shows an index for the order intake among the members of the Confederation of the British Industry. It indicates an unexpected improvement from September to October, reaching index minus 34, which was a positive surprise, although still below the long-term average of minus 14. As graphic two shows, the expectations in the manufacturing sector are at an even higher level than before the Covid-19 crisis.

The surveys were taken just three months ahead of a potential hard Brexit, where a Brexit in the same surveys in prior years, have weighted somewhat more negative. Again, it’s an indication that the Covid-19 crisis is regarded as a true crisis and the Brexit, even a hard one, can be manageable.

The current improvements in the indices, I assess as too optimistic, as they do not include the latest explosion in the Covid-19 cases across Europe, including UK, but it is a Covid-19 issue and not a Brexit risk.

If one dives into the sub-indices, it is obvious that many UK corporations are postponing new investments, developments, major hiring plans etc. until the potential hard Brexit has been executed. There is no doubt that the Brexit will weigh on the British economic growth during the transition period, though the sub-indices by no means indicate any fear among manufactures, just the uncertainty that surrounds any major change.

The investors have several times priced “fear” and “crisis” in the UK stock market and many large international investors remain underweighted in UK stocks. For the same reason, I keep my long-term view that as soon as the Brexit issue is executed (including a hard Brexit), then investors will flock back into UK stocks, as too much “fear” and gigantic holes in the road are currently priced into British stocks.