Chinese consumers enjoyed the New Year

The Chinese New Year holiday is over, so the Chinese are now starting to return to everyday life in the “Year of the Ox”. Last year, the New Year holiday was basically cancelled, as Covid-19 raged in China at that time, but this year, it was possible to celebrate the New Year. However, despite the fact that the virus is under control in China, the threat of the virus alone nevertheless played a decisive role in the activities in connection with the New Year this year.

From an economic and investors’ perspective, the holiday week in connection with the Lunar New Year is always unbelievably interesting. It is the week when the whole of China is on the go, whether it concerns travelling home to the annual family visit, a holiday trip, meeting with friends, and of course, shopping as a central activity for many. The New Year’s week, also called “Spring Festival”, is for the same reason, an incredibly good indicator of how the temperature is among consumers. In my opinion, this plays a big role at the moment, as it is private consumption that will be the foundation for the next quantum leap in China’s economic growth.

Prior to the holiday week, the government had called for people not to travel around the country. It has affected the domestic travel industry, and since part of the domestic migrant workers have stayed where they work, it has had a further effect.

During the New Year’s week, the migrant workers usually go home in the rural areas, which means that extra money is spent on, for example, restaurant visits. This share of the retail sales and entertainment economy this year will be partly missing in the rural areas, and in the economic activity.

I mainly expect this to be case in the northern part of China, conversely, the large cities and metropolitan areas further south and along the coast, weigh significantly more in the overall economic growth, thus in the GDP growth.

The Chinese have been out to entertain themselves during the holidays, like going in the cinema. One of the cinema chains, Maoyan Entertainment, has seen a 33 pct. increase in ticket sales during the first five days of the New Year week compared with the same period in 2019 (last year it was closed due to the Covid-19 outbreak). This is a new record in the number of cinemagoers, and the share prices of the companies that run cinemas have already skyrocketed.

Shopping malls in China have changed direction over the past several years and focus more on entertainment and less on ordinary shopping, which can be conducted online. The first reports I have seen indicate that there have been the same number of visitors as back in 2019, and thus before the Covid-19 crisis.

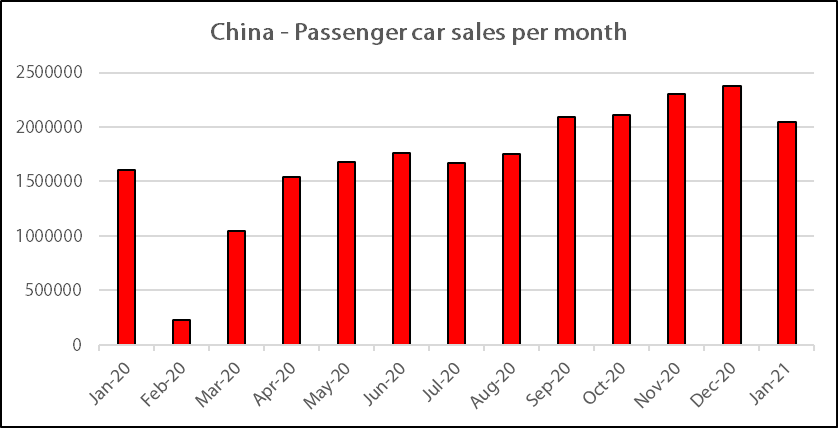

Some in the retail sector have begun to dream of retail sales with an annual growth rate back up above 10 pct., and with good reason. Since last year, car sales have increased so much, that they have even rescued the 2020 results for the German car manufactures. As graphic one shows, the Chinese car sales have increased significantly after China got out of the Covid-19 lockdown, and even more cars were sold at the end of 2020 than during the same period the year before.

In all economies around the globe, there are weaknesses, which is also the case in China. The housing prices are developing quite differently from Western countries, as shown in graphic two. The graphic shows the annual price change of new homes in 70 of the largest cities in China. The price increase in December was the lowest increase since February 2016, and if one looks at the monthly increase from November to December last year, it was just 0.1 pct. However, there is nothing surprising in the development, as the Chinese government has long been working towards cooling down the real estate market. I do not think this current price development poses a major risk to the financial comfort of households, as the movement in prices is smooth, and many buyers in China often make large down payments when they purchase their own home.

In my view, there is no doubt that the Chinese consumer is gaining foothold again, but the development is not yet what I would describe as strong, as the trust in the future is still not that distinct among consumers. The latest official data on consumer confidence even showed a slight dip in December, which is not a disaster, but conversely, I think it reflects the current situation quite well. Though private consumption must be accelerated to ensure China’s economic growth moving forward.

Therefore, I still see the upcoming annual NPC congress (National People’s Congress) in China as the opportunity where private consumption can get its extra vitamin supplement, which is needed to spark private consumption toward new levels.

Different types of incentives are possible, though they must be long-term solutions, as private consumption in China is the economic force that should help China become the biggest single market in the world. Further, it is the new five-year plan that will be presented on the NPC Congress next month, so I expect there will be good excitement among investors ahead of that session in March.