China prepares for 100-year anniversary

The 1st of July 2021, will mark the 100th anniversary of the Chinese Communist Party, led by President Xi Jinping. This event will undoubtedly cause for a celebration in China, where over the past ten years, political leadership has prepared China’s economy for this event.

A decade ago, then-President Hu Jintao, stated that the total GDP should be twice as large in 2021 compared to 2010- an accumulated GDP growth of 100 pct. through that period. In comparison, the total GDP in the Eurozone just increased 10 to 15 pct. during the corresponding period (before the Covid-19 crisis). Despite the fact that China’s economy comes from a lower level than the West, if measured in GDP per capita, the 2010 target was quite ambitious. It’s always interesting if ambitious goals are met, but even more important for investors is if China’s economy is fit when the round anniversary is celebrated?

In any current assessment, Covid-19 is on the top of the mind, and the virus will also play a role in China’s economic ambition. Had the virus not emerged, China would have probably almost reached its target of 100 pct. GDP growth, which would possibly have landed at 98 pct., but after getting hit by the Covid-19 crisis, the target is now out of reach.

China has made great efforts to free itself from Covid-19 and on an ongoing basis, very extensive work is being done to contain new cases. As an example, two weeks ago, 12 new cases were found in the city of Qingdao, which has 9 million citizens. During the first week, 3 million people have already been tested and the plan is to test all 9 million citizens. If China manages to keep the number of infected cases at a low level, then for that reason alone, the country’s economy will appear more fit than many other economies around the world. That in itself is interesting, but of course, it is essential how China’s economy fundamentally develops.

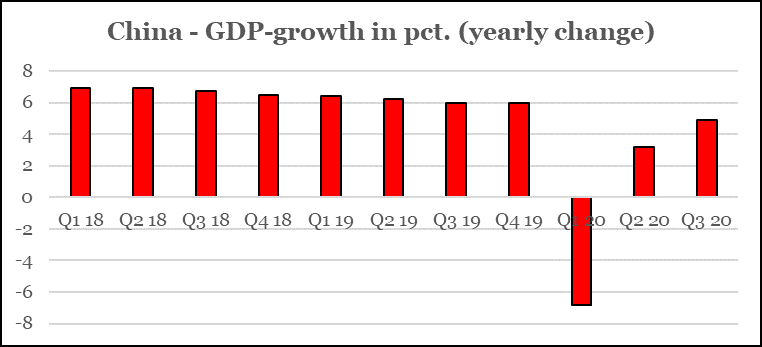

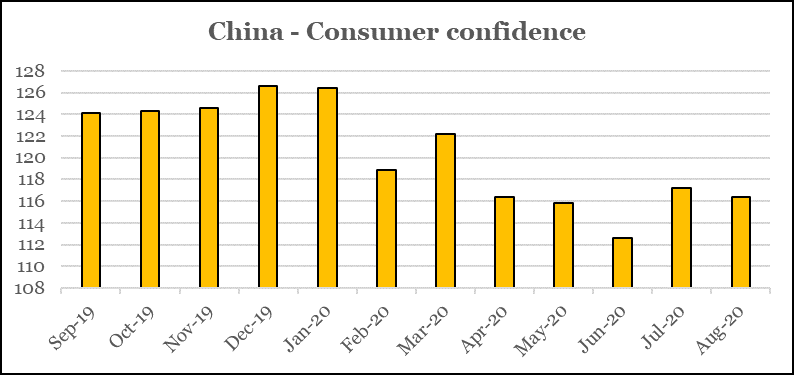

Currently, the Communist Party is holding its annual party congress, which takes place in the shadow of a GDP growth for the third quarter at an annual rate of 4.9 pct. against the expected 5.2 pct. (graphic one). As such, private consumption is increasing in a satisfactory level, understood in the sense that the progression follows economists’ expectations. To cut it short, I argue that the rise in private consumption is not strong enough to make the economy really fit. This is in line with the consumer confidence, which still is lagging behind the level from before the Covid-19 crisis.

In order to boost domestic demand further via higher private consumption, the party congress will, among other things, discuss the next step, which is the development of the “dual” economy. My expectation is that the conclusions on this, including some growth initiatives, will be presented in the new year. It will therefore surprise me if these are reforms where economic growth can become noticeable before next year’s big anniversary party. But another sector in China is extremely attractive and fit, the private sector.

My position is that the companies originating from the private sector (as many outside China would put it) are the part of China’s economy that is most fit. Just like in the US, China has its tech and web giants that are really growing and have colossal growth ambitions. This will have a major impact on how fit investors experience China, and it is my impression that an increasing number of investors are becoming aware of the potential. It is precisely in the private sector that investors would benefit to have their focus concerning investment opportunities, and as always, many are surprised by how fast developments happen in China.

A giant like Alibaba naturally has an appetite for more online revenues, which is why the company is entering the sector selling “lifestyle” products, such as food delivery, though it can also be the sale of cinema tickets. Just to enter the market, Alibaba bought into Ele.me, which was valued at 9.5 billion US dollars in 2018, and only gave a limited position within this market segment, but by no means a significant market share. The dominant company is Meituan Dianpi, that has built up a huge dominance in this market segment over the past 10 years, and the company is now worth about 180 billion dollars. The ambition of this company is that 100 million purchases will be processed via the company’s platforms every single day, which is quite ambitious, even in a country with the size of China. In a number of sectors, one finds similar growth opportunities, so many investors will surely experience China as quite fit for the anniversary party.

In adherence of upholding our company’s “Code of Conduct” in the columns we write, we must disclose that our investment fund, Lundgreen’s Capital – China, has investments in the companies Alibaba and Meituan Dianpi. These investments, however, do not affect the conclusions of the column.